PLATMA — Unlocking Bank 6.0

On-Prem Bank Operating System with AI. Enables the bank to deeply understand each client and offer the right products at the right time — boosting cross-sales by at least +16%

About PLATMA

PLATMA is a technology company, resident of IT Park Uzbekistan and the DIFC Dubai AI Campus. Established in 2022

Our Flagship

PLATMA Bank 6.0 — an operating system for banks that can be deployed on-premises or in a hybrid environment

Recognition & Partners

PLATMA has been recognized as the best AI company within DIFC (UAE). Our strategic partners include UZCARD, Asseco Group, Schneider Electric, and others

Winners of the FutureTech World Cup 2024

Our solution has emerged as the best AI solution in 2024 in the UAE and MENA region

$3M+

Secured funding

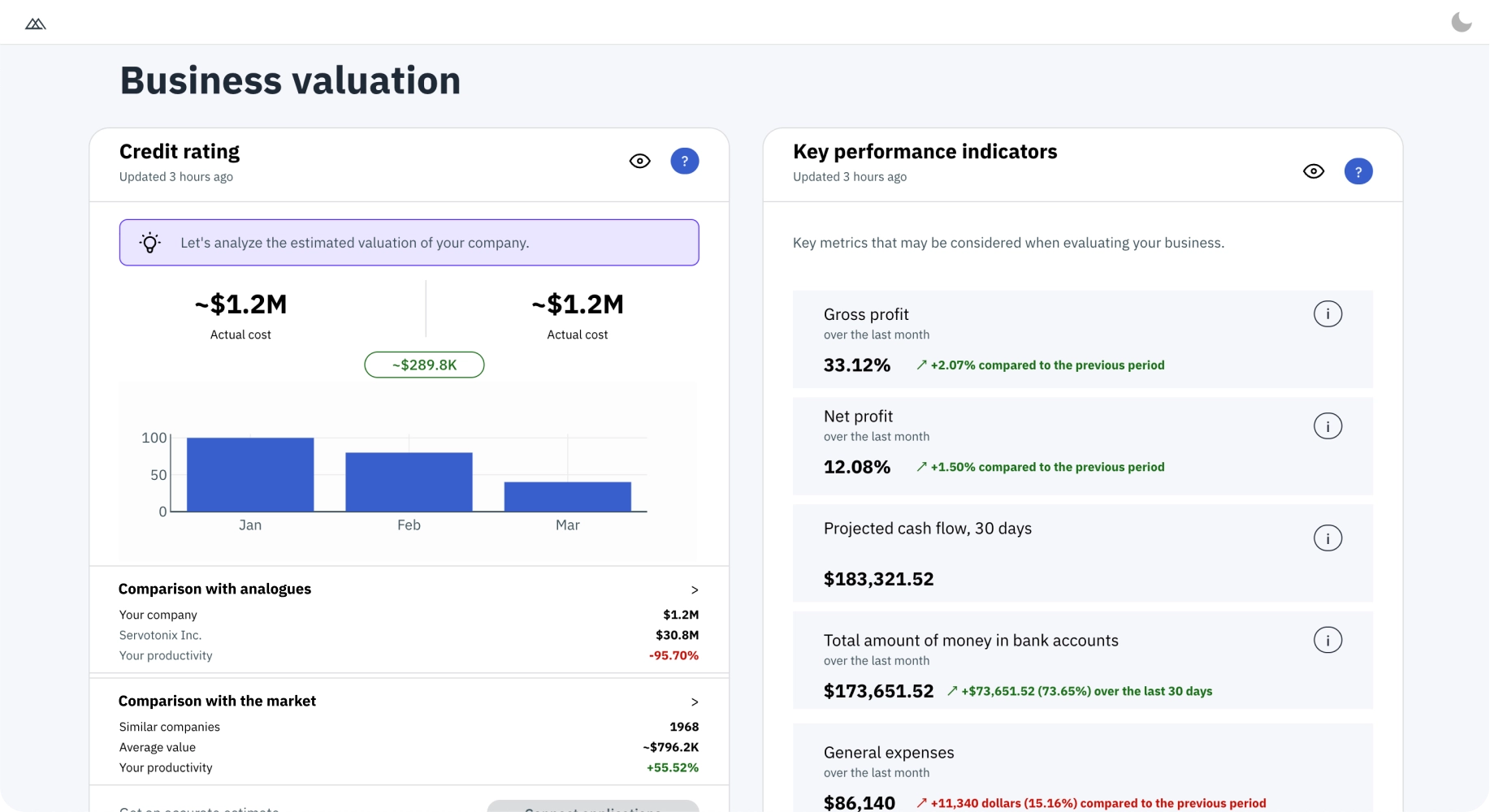

~$40M

Overall Valuation

Investors

Accelerate Your Journey to Bank 6.0 with PLATMA

We operate where market demand meets speed of implementation — a platform built for large-scale banking scenarios

Why It Matters

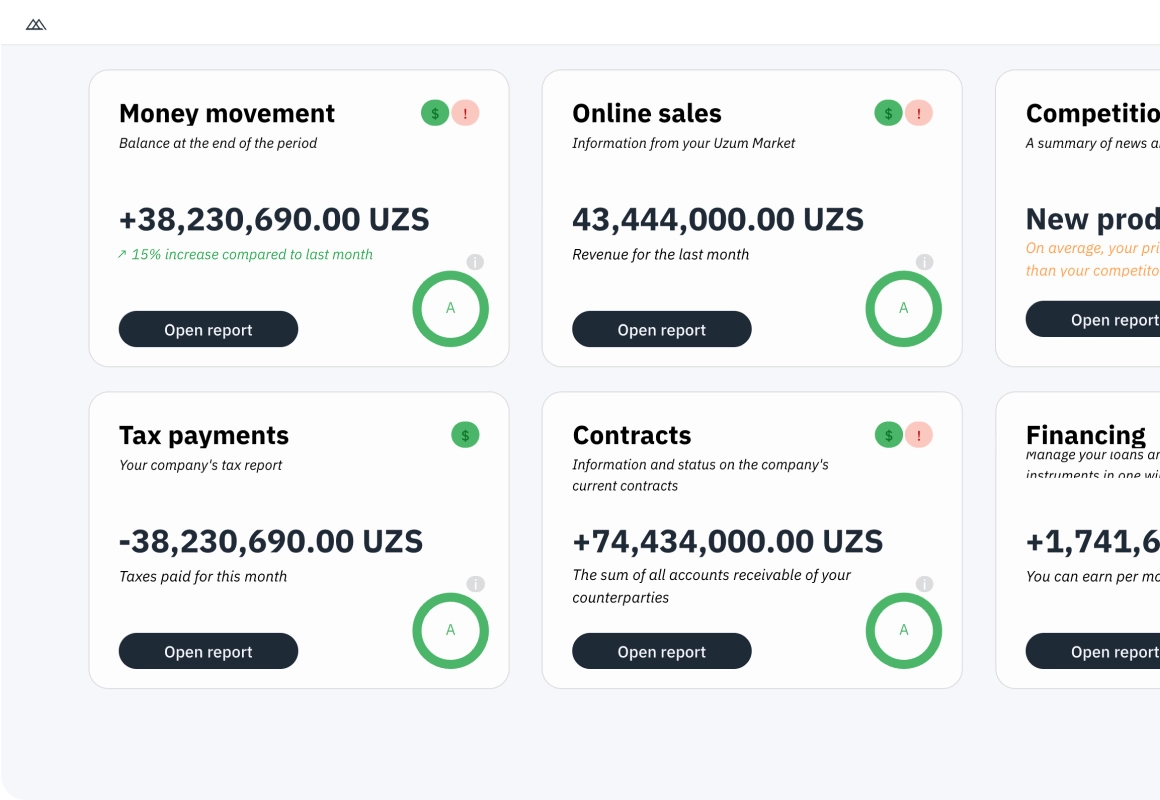

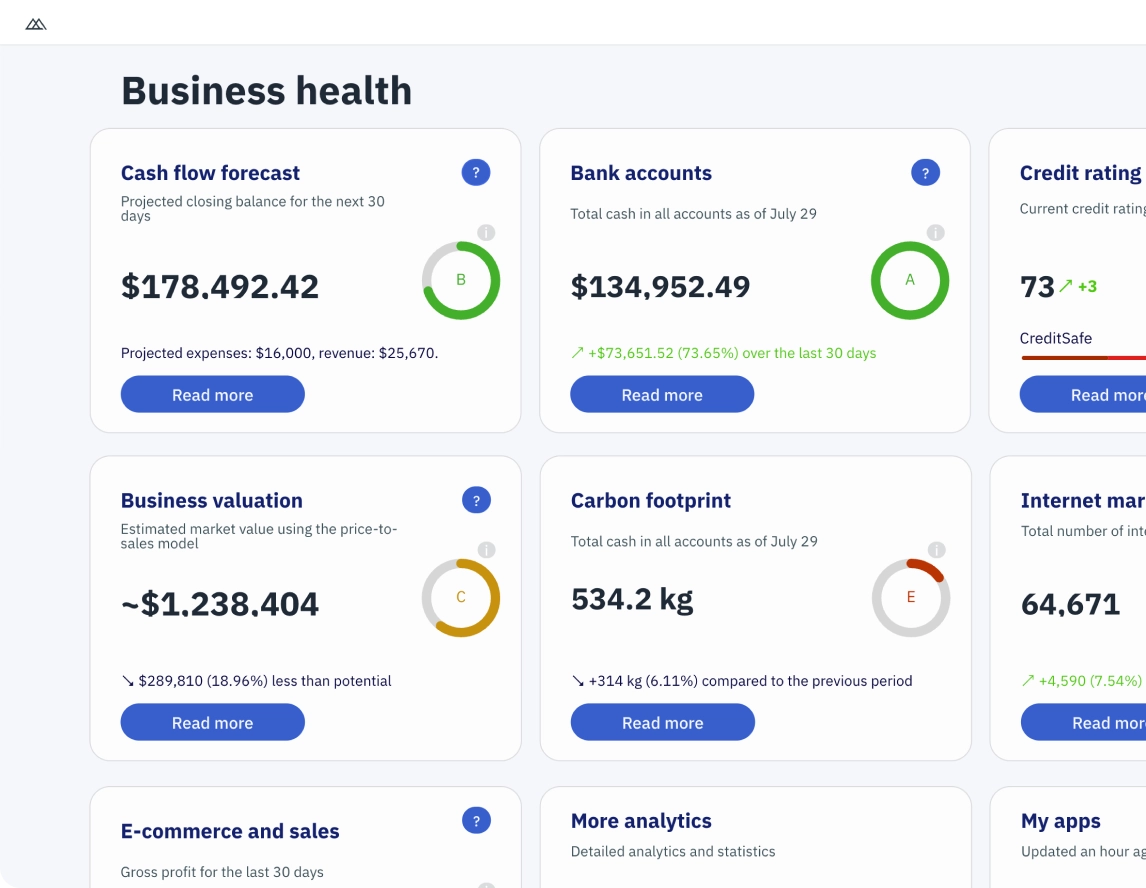

With PLATMA Bank 6.0, banks unify both banking and non-banking data — from accounting systems to government registries — into a single normalized model with actionable insights for client retention.

SMEs gain a transparent, up-to-date view of their operations, while the bank gains the context to deliver relevant product offers such as credit, factoring, leasing, insurance, and deposits.

Current Market Landscape

Digital platforms and artificial intelligence are shaping the foundation of modern banking products. Technology investments continue to grow, while small and medium-sized businesses remain a major source of demand

AI in Banking

≈ $11.6B (2024)

Bank IT Spending

≈ 10.6% of revenue

Digital Banking Market

≈ $12.9B (2024)

SME Contribution

>50% of total employment

How PLATMA Bank 6.0 Transforms Banking

1

2

3

4

Implementation

Go Live in under 2 months with 120+ automated integrations

Operational Speed & Quality

Visual development and automated integrations — first product in production within 1 week

Commercial Impact

Driving an average of +16% growth in cross-sales

Savings

AI over routine — process automation and personal AI assistants make work faster, more accurate, and more cost-effective

PLATMA Bank 6.0 — one operating system where data works for the bank

Use Cases & Impact

PLATMA Bank 6.0 positions the bank as an active business partner — driving cross-sales growth, improving client retention, and reducing operational costs

+16%

Average cross-sales growth for banks after implementing PLATMA Bank 6.0

>25%

Growth of SME loan portfolio in implemented projects

Driven by automated scoring, real-time business data, and instant product personalization

Request a demoHow We Make It Happen

Step 1

We deploy the solution on-premises or in a hybrid environment to ensure regulatory compliance and data protection

Step 2

We connect key integrations through an API-first approach

- Core banking, loan origination, payment and treasury systems, asset management, digital banking, analytics, and cash flow control

- Government Registries

- Business apps including CRM, ERP, e-commerce platforms, Google Analytics, and leading MMPs

Step 3

We launch a PoV

discovery

integrations

visual logic

testing

KPI measurement

Working closely with the bank’s product and operations teams

PLATMA Bank 6.0 Architecture

On-Prem (Local)

Full control over data, regulatory requirements, and security

Best for

major banks with stringent data storage and compliance needs

AI Features

AI predicts key events and triggers personalized campaigns, helping the bank offer the right solution at the perfect moment — boosting conversion and loyalty

Best for

- For Marketing Teams

- For Product Managers

- For Sales and Analytics Teams

- Risk Management Teams

- SME Banking Department

AI Triggering

Monitoring sales, stock, payments, and campaigns to instantly activate the right offers and communications

Pre-Approved Offers

The platform uses data to generate credit, factoring, and leasing proposals — so the client gets a solution without lengthy checks

AI Campaign Agents

They launch email, push, SMS, and targeted campaigns, run A/B tests, and select the optimal send time

Personalization & ROI Forecasting

The model predicts sales uplift and campaign profitability before launch — giving marketers visibility into expected results and risks

Cross-Product Coordination

The platform connects credit, factoring, insurance, and deposits into a single chain of offers to grow customer LTV

Automated Retention

When churn signals appear, the system analyzes the cause and responds with tailored, more competitive offers

Teams

Our Partners

Ready to Test the Impact?

Let’s launch a pilot with your team

A pilot project demonstrates real commercial and operational impact in a short time

Request a PilotMeeting & Demo

30–60 minutes: we showcase the platform through real scenarios and discuss your business goals

NDA

We sign a confidentiality agreement and define the framework for data exchange

Business Audit

We gather requirements, check integrations and data, and assess risks and access rights

Solution Design

We define the scope of the pilot, agree on KPIs and integration plan, and prepare the environment — 2 to 4 months

Go Live with Pilot

PoV in action: integrations, visual logic, testing, and KPI measurement

clients

employees

offices